Deciphering Energy Markets with Dynamic Mode Decomposition

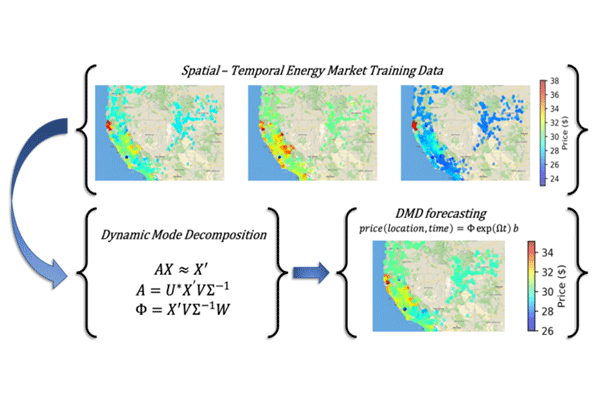

Energy markets are ubiquitous across the globe and offer significant revenue opportunities for emerging energy technologies and flexible energy-intensive industrial consumers. Effectively exploiting these opportunities requires reliable and accuracy short-term forecasts. Both classical time-series analysis and machine learning techniques such as ARIMA, GARCH, neural networks, nearest neighbors, and hybrid learning have been applied to energy price forecasting with mixed success. In contrast, in this work, we quantify the ability of the emerging Dynamic Mode Decomposition (DMD) techniques to learn nonlinear dynamics that drive spatiotemporal price fluctuations and make predictions for optimal control formulations.